Subscription rights trading

Subscription rights trading

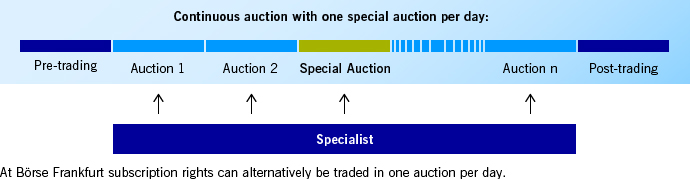

Trading in subscription rights at Börse Frankfurt is conducted in the “Continuous Auction with Specialist” trading service. Trading in a subscription right can take the form of one auction a day within a fixed timeframe or continuous auctions across the trading day with one special auction a day. All orders that have not been executed or only partially executed and are still in the order book on the evening of the penultimate trading day are automatically deleted and have to be re-entered the next (last) trading day to the extent that this is requested.

For subscription rights traded in continuous auctions with one special auction a day, the first price determination takes place on the first day of trading in the subscription right by means of a special auction. A special auction does not take place at a fixed point in time, but is conducted by the Specialist within a timeframe defined by the exchange during the main trading phase. The price determined in a special auction is identified as such.