Exchange Solutions

Exchange Solutions

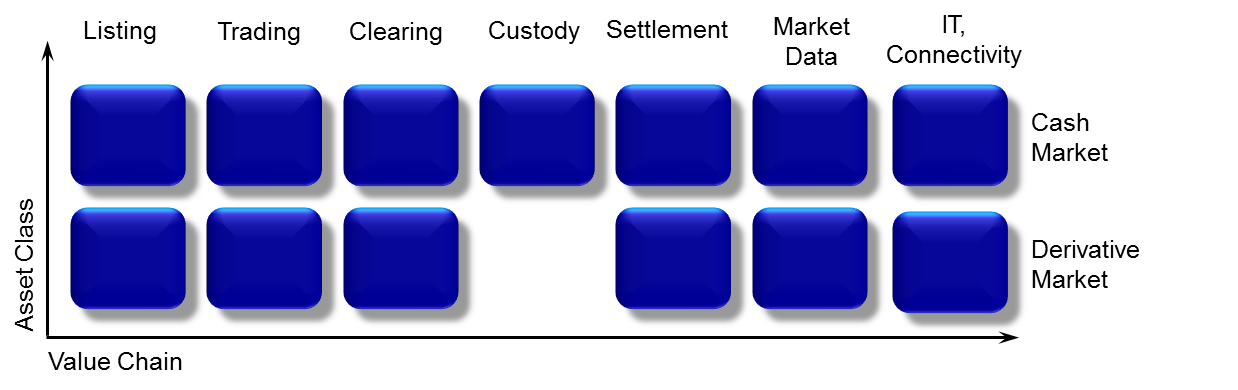

Deutsche Börse is one of the world's most sophisticated exchange operators and provider of IT solutions for cash, commodities, digital assets and derivatives market operators. As the technology provider and operator of major European financial markets we are setting industry standards and offering know-how along the whole capital market value chain:

Deutsche Börse provides a full range of outsourcing services to exchange organizations, multilateral trading facilities (MTFs) or companies intending to establish off-exchange trading systems.

Our cooperation partners benefit from a dedicated infrastructure including scalable high-performance backend hosting and network infrastructure with a full range of connectivity options for your customers. Moreover, you can benefit from a full scope service as we execute the operation for you.

Our high-quality products and services solutions transport well-founded expertise of powering and operating markets to a number of venues worldwide. As of today, more than 25 exchanges and marketplaces utilize Deutsche Börse Technology and outsource operation services to us. The reason is quite obvious, we provide our customers with quality, flexibility and efficiency through the utilization of state-of-the-art trading infrastructure services.

Our team guides you smoothly through the complete service implementation process and ensures that your business starts on time and within the planned budget.

Our customers speak for our extremely high-quality standards.

We are happy to discuss and tailor your solution. Do not hesitate to contact us.

References

Below is a list of customer satisfaction related to our outsourcing solutions: |

|

|

|

|

|

|

|

1 via Wiener Börse AG as a service provider