Continuous Auction with Specialist

Continuous auction with Specialist

Continuous auction with a Specialist begins with the pre-call phase, which is followed by a freeze phase. Pricing then takes place.

During the pre-call phase all market members can place, change and delete orders. Furthermore, the Specialist can place, change and delete orders.

During the freeze phase, the order book is frozen. During the freeze phase, the system collects order inputs, changes and deletions in a “suspended portfolio” until the freeze is lifted, whereupon they are immediately processed.

During the freeze phase, the Specialist can place, change and delete orders in his own name or for other market participants.

The Specialist’s duties

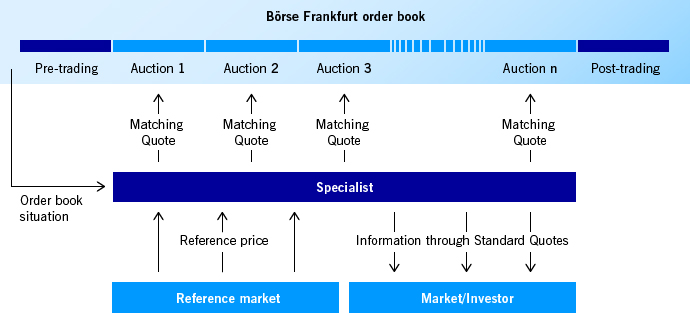

In the continuous auction with Specialist model, the Specialist guarantees the high quality of trading by carrying out the following duties:

- Ensuring continuous market information by inputting Standard Quotes during the entire trading period:

In the Standard Quotes, the Specialist takes the order book and any possible reference market into account. In each Standard Quote, the Specialist must consider the maximum spreads and minimum quote volume agreed with the Frankfurt Stock Exchange. - Initiation of price determination in the case of executable order book situations by inputting a Matching Quote:

There is an executable order book situation, if: (1) an order can be executed against another order; or (2) against the Specialist’s Standard Quote; or (3) the Stop Limit of a Stop Order has been reached by the Standard Quote. Through the Matching Quote, the Specialist defines the spread within which the trading system calculates the price in accordance with the principle of highest executable volume. This way, the Specialist ensures that orders are only executed at market prices. - Provision of additional liquidity to bridge a lack of offer or demand for the execution of an order

- Avoidance of partial order execution