Service Navigation

Business areas

Business areas Deutsche Börse Group at a glance

As an international exchange organisation and innovative market infrastructure provider, Deutsche Börse Group ensures capital markets characterised by integrity, transparency and stability. With its wide range of products, services and technologies, the Group organises safe and efficient markets for sustainable economies.

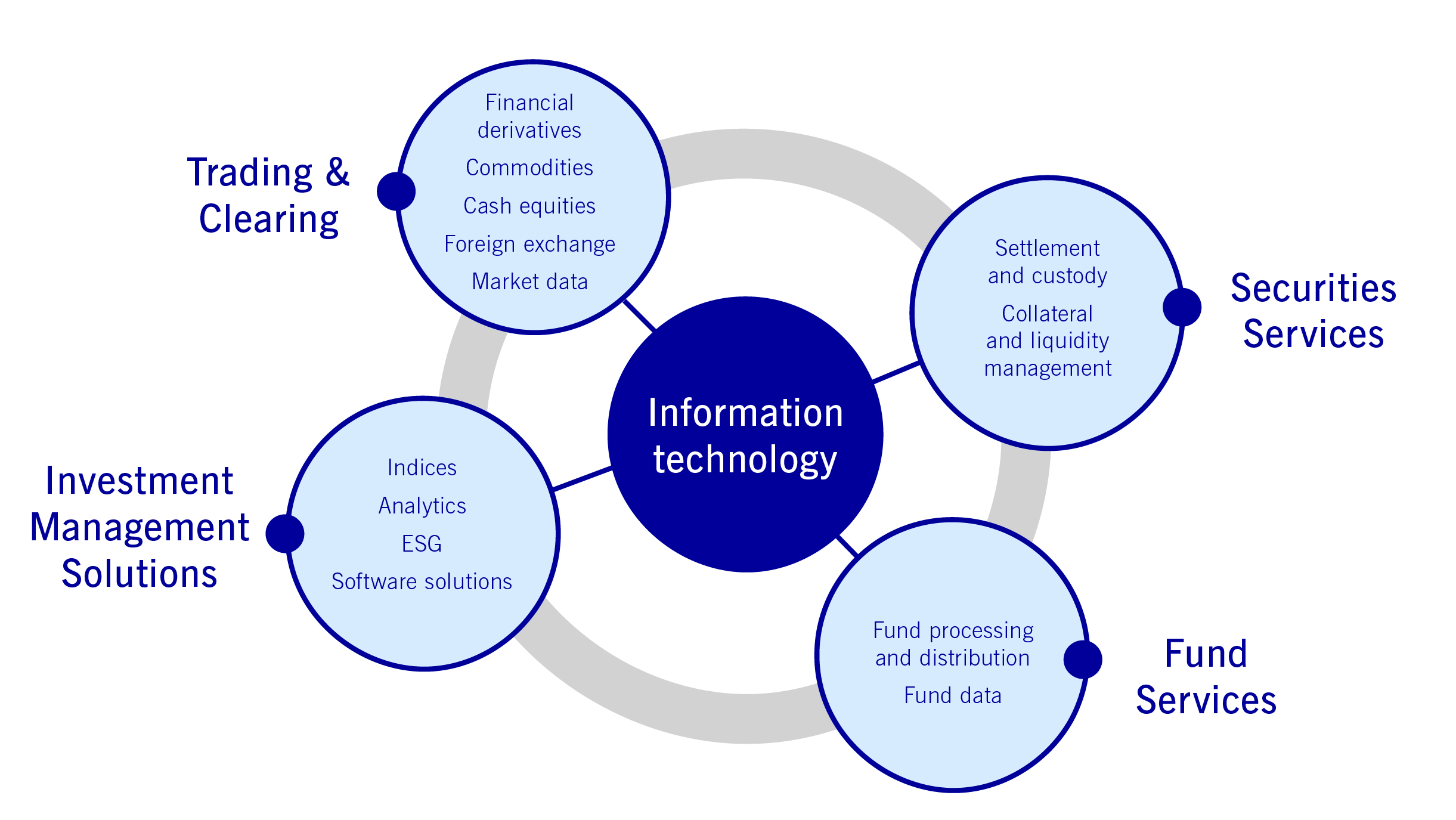

Our business areas cover the entire financial market transaction process chain. They can be assigned to four areas which are described in more detail below.