Clearing

Clearing

Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange) has an arrangement with Eurex Clearing AG for the clearing of transactions executed on the trading venues Xetra® and Börse Frankfurt (Frankfurt Stock Exchange).

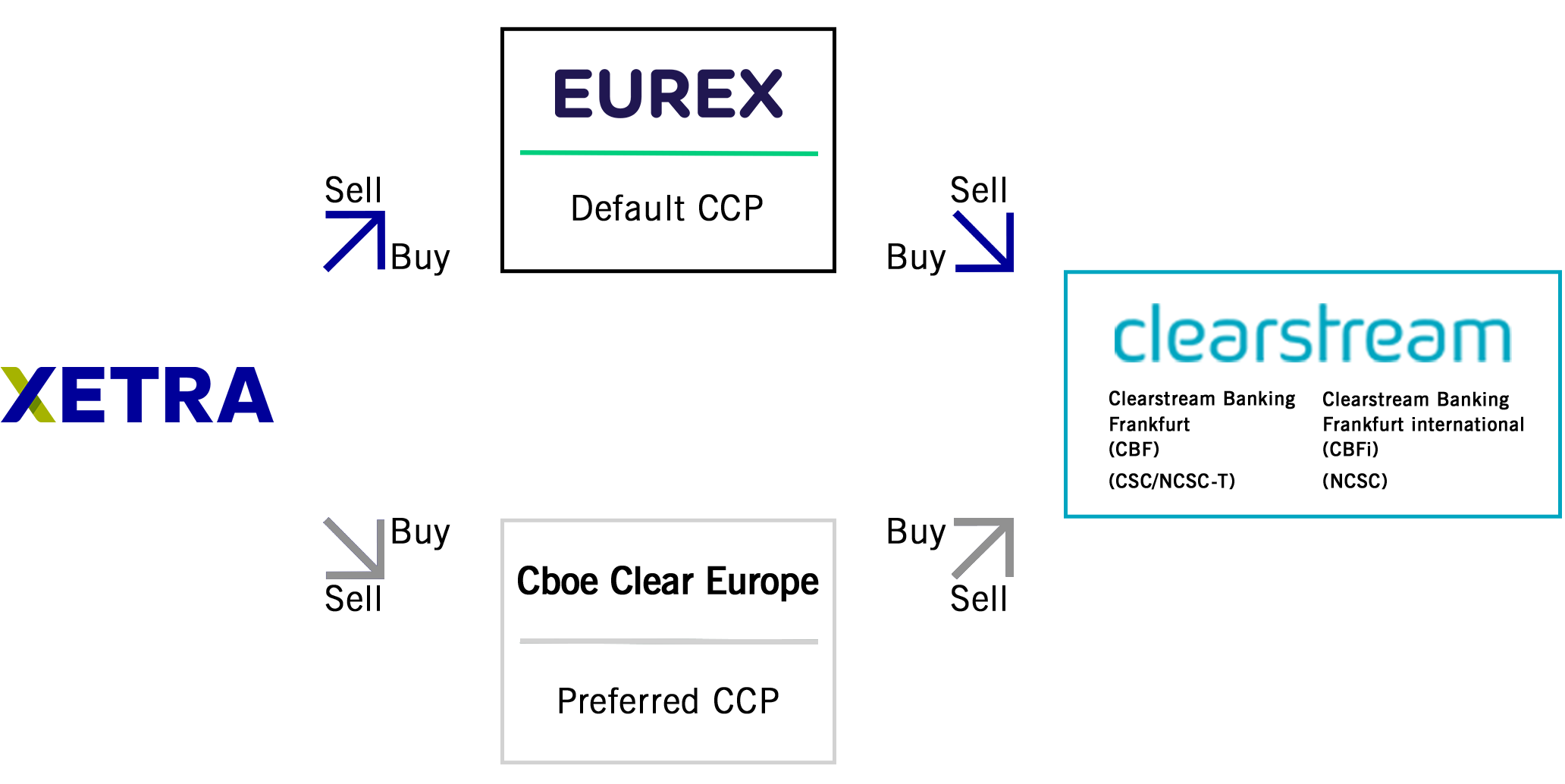

Eurex Clearing AG acts as a central counterparty (CCP) for all CCP-eligible instruments, in other words as the buyer to all sellers and as the seller to all buyers, thereby minimising counterparty risk and enhancing operational efficiency.

For the clearing of transactions executed on the trading venue Xetra, trading members may appoint for selected instruments the Cboe Clear Europe N.V. as its Preferred CCP in addition to Eurex Clearing AG (Default CCP).

In the so-called "Preferred CCP Model" Xetra transactions, in which both the sell and the buy side of a transaction have selected the same CCP as their Preferred CCP, are cleared by the Preferred CCP.

In all other cases, the default CCP clears the respective transaction. If a preferred CCP is selected, there must also be a clearing relationship with the Default CCP.

Which instruments are available for clearing via the Cboe Clear Europe N.V. (Multi CCP-eligible) can be found in the "All tradable instruments" list.

If you are interested in the Preferred CCP Model, please contact your Key Account Manager.